Gift of money to the Government State Government or Local Authorities. Amount is limited to 7 of aggregate.

Tax Deductions For Building Materials The Ins And Outs Of The Process

List Of Guidelines Under Subsection 4411D Of The Income Tax Act 1967.

. Amount is limited to 10 of. Is my donation tax exempted. Gift of money to Approved Institutions or Organisations.

Here are 5 tax exempted incomes that can easily apply to you. Darsshni Follow Yes under sub-section 44 6 of Income Tax Act 1967 and all cash donations to Malaysia are tax deductible applicable only to donations. List Of Guidelines Under Subsection 446 Of The Income Tax Act 1967.

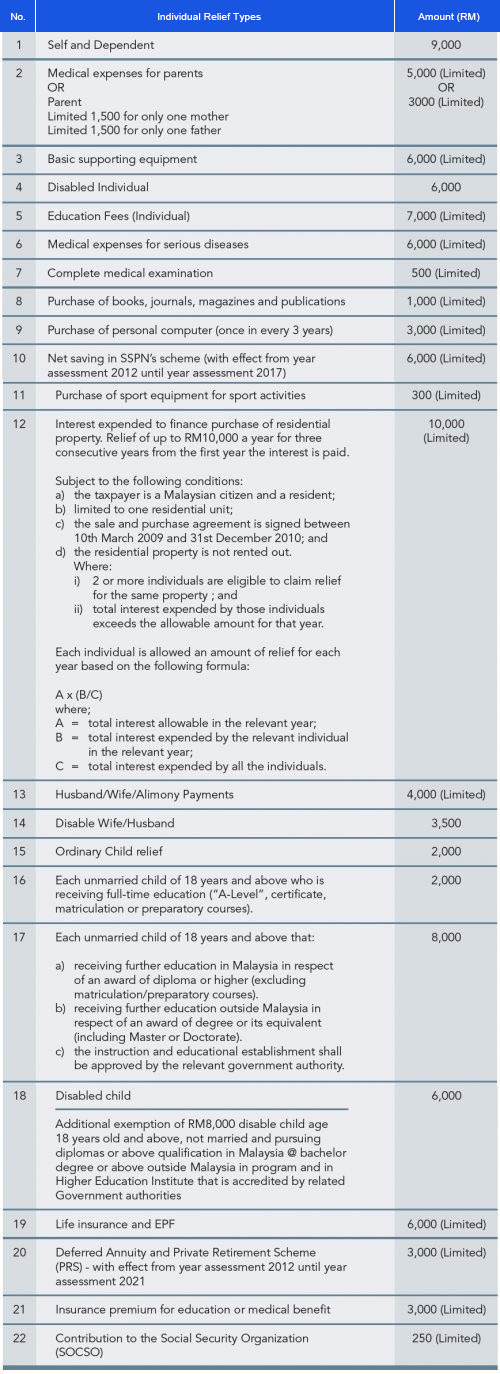

Gift of money to Approved Institutions or Organisations. The IRB in a statement today said the incentives provided under the Income Tax Act 1967 were for the Ministry of Healths Covid-19 Fund involving donations of cash and items. List of Tax Exemption in Malaysia Year of Assessment 2021 e-Filing 2022 For resident individuals as updated on 11 January 2022 1.

Gift of money to the Government State Government or Local Authorities. Hatimy does NOT collect. Even when a person retires and doesnt have income from a job anymore their.

Tax Incentive Scheme For Operational Headquarters OHQ Guidelines to Apply Discount On Contribution to Community Projects and Charity. Income Tax Exemption for Non-Profit Organisation Leave a Comment Tax By MalaysiaCare TYPES OF INSTITUTIONS OR ORGANISATIONS ELIGIBLE TO APPLY FOR APPROVAL UNDER. If you are a Malaysian citizen you are entitled to tax exemption for all cash donations as defined under sub-section 44 6 of Income Tax Act 1967 Government.

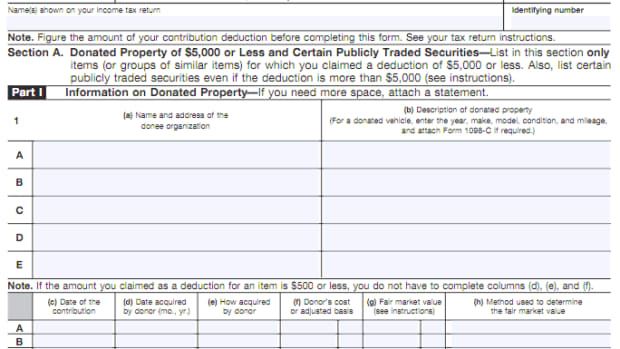

A4 TAX EXEMPTION APPROVAL Enter 1 if tax exemption has been granted to the association or 2 if no tax exemption has been granted or the association has never applied for any. A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. Who can contribute donate under paragraph 346h of the ITA 1967.

Is my donation tax exempted. Tax Exemption Guidelines under Subsection 44 6 Income Tax Act 1967. However if you claimed a total of RM11600 in tax relief your chargeable income would.

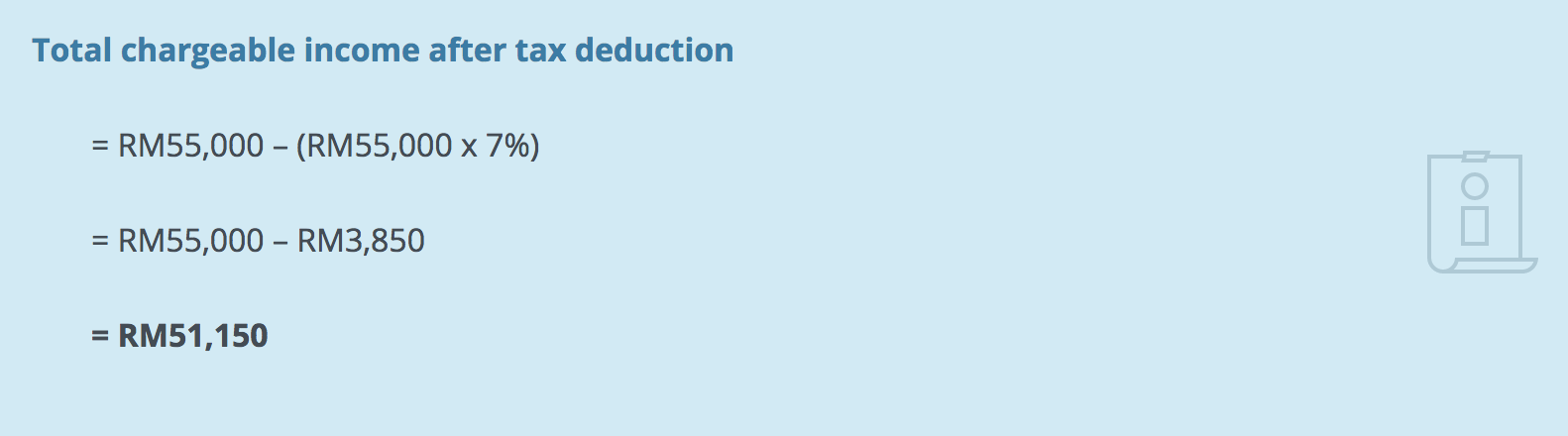

Subsection 44 6 2. The only solution for such organisations to be exempt from tax is to apply for approval under Section 44 6 of the Income Tax Act 1967 ITA which will automatically exempt the charitable. For example if you earn RM55000 annually the maximum amount thats deductible is RM3850.

Monies received as death gratuity are fully exempted from income tax. Guidelines Of 100 Exemption. Based on this amount the income tax you should be paying is RM1000 at a rate of 8.

Every donation goes to Touching Hearts Welfare Society Kuala Lumpur and Selangor and is exempted from tax under sub-section 446 of Income Tax Act 1967. Donations to charitable institutions. By Ministry of Health Malaysia.

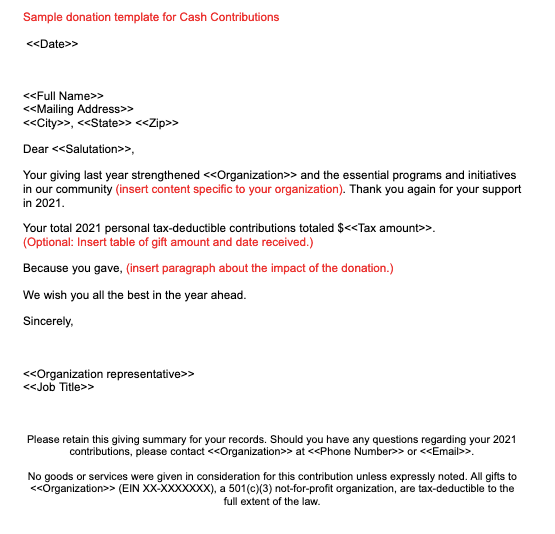

Contributors with business income are entitled to a deduction from gross business. Tax Exemption Receipt shall only be issued to the personcompany that makes payment name. Is my donation tax-exempted.

Based on the revised guidelines the donor is required to provide complete information of the details stipulated below in order to obtain an official receipt or tax-exemption receipt from the. The Malaysian government caps it off at 7 of your annual salary. Yes WWF-Malaysia is an NGO under sub-section 44 6 of Income Tax Act 1967 and all cash donations to WWF-Malaysia are tax deductible applicable.

Any monies paid by way of scholarship to an individual whether or not in.

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Tax Benefits For International Giving Give2asia

13 Tips For Making Your Charitable Donation Tax Deductible In 2017

Bts Malaysia Army On Twitter Receipt From Mercy Finally Arrived Https T Co 0wpfdfsbmn Twitter

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

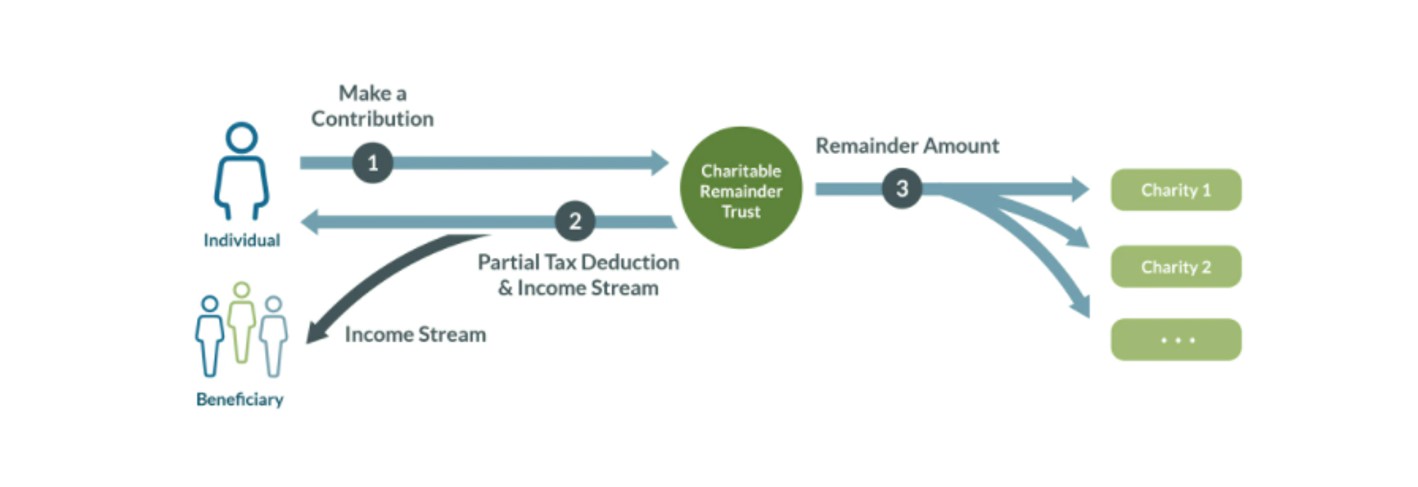

The Charitable Remainder Trust Crt And Crypto Htj Tax

Donating Your Stimulus Check 4 Key Tax Rules To Know

Global Covid 19 Individual Income Tax Responses Airinc Workforce Globalization

New Universal Tax Break For Charitable Donations Included In Final 2 Trillion Covid 19 Stimulus Package

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Tax Knowledge For Individuals And Households Toughnickel

Working Together For The Animals Animalcare

How To Get A Clothing Donation Tax Deduction Toughnickel

Understanding Tax Smeinfo Portal

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox